By Jack Kraft, CFA, Investment Strategist

![]() Print This Post

Print This Post

U.S. equities ended the week at all-time highs as traders rotated into sectors expected to benefit under a Trump administration. The S&P 500 and Dow Jones Industrial Average each rose 4.6%, bringing their year-to-date gains to 26.4% and 16.6%, respectively. The Nasdaq outperformed, adding 5.7% and pushing its year-to-date performance to 30.6%. Small-cap companies saw the strongest gains, with the Russell 2000 surging 8.6% for the week.

Treasuries were also in focus, with the yield curve flattening as shorter-term yields fell more sharply than longer-term yields. After an initial 15-basis-point increase following the election, the 10-year yield ended the week effectively flat at 4.31%.

All 11 S&P 500 sectors finished the week higher, with consumer discretionary, energy, financials, industrials and technology all jumping more than 5%. Meanwhile, consumer staples stocks were the clear underperformer, adding less than 1% during the five-day stretch. The consumer discretionary sector was driven higher thanks to Tesla, which jumped more than 30% to rejoin the “trillion dollar market cap” club. This move brings attention to the Magnificent Seven, which, as a group, has returned 45% year-to-date and accounts for 47% of the total return to the S&P 500 for the year. The move is warranted given the group continues to grow earnings at an impressive pace. If Nvidia reports earnings in line with consensus estimates, the Magnificent Seven will have grown aggregate earnings 30% year-over-year for the third quarter, according to Goldman Sachs. Conversely, the remaining 493 stocks of the S&P 500 grew profits by 3% over the same period.

Markets prefer certainty, and with the U.S. Presidential Election ending without any delays and a clear victor, the stock market shot up in a frenzy. Pockets of the market surged following what looks to be a Republican sweep (winning the White House, Senate control and possibly House control). Money managers rushed to position for a new administration, with the most notable rally in financials amid optimism surrounding deregulation. In fact, the S&P Bank ETF (KBE) surged 10% on Wednesday. Elsewhere, asset managers and companies tied to investment banking jumped, with Morgan Stanley and KKR both rising 10% as well the day after the election.

Companies that have been in talks to be acquired also rallied on hopes that deals will receive less scrutiny under the new administration. Discover Financial, who is in talks to be acquired by Capital One, saw shares rise 18%, while Kroger, who is in the middle of trying to acquire Albertsons, caught a bid. Shares of Visa also gained 4% the day after the election, which has been a target of an anti-competitive dispute by the Department of Justice.

Not all areas of the market participated in the rally though. Stocks tied to clean energy, such as First Solar and Enphase, declined 10.1% and 16.8%, respectively, the day after the election. Meanwhile, stocks that import goods, such as consumer discretionary clothing companies, faced a headwind from Trump’s proposed tariff plan. In fact, the shoe company Steve Madden is already getting ahead of possible increases in tariffs by announcing plans to import fewer goods made in China. Conversely, stocks that derive most of their revenue from the U.S. popped on hopes of lower corporate tax rates.

In 2017, the Trump Administration passed the Tax Cuts and Jobs Act (TCJA), which made substantial changes to the U.S. tax code, reducing the corporate tax rate from 35% to 21%. The TCJA was set to expire in 2025, but the new administration has heavily emphasized extending the tax cuts beyond 2025 and potentially reducing corporate tax rates even further. This, coupled with deregulation efforts, could stimulate corporate spending and accelerate economic growth favoring domestics, cyclical and small-cap companies. Additionally, these policies could provide a tailwind to broadening out of market leadership away from the mega-cap technology companies.

Third-quarter earnings season is in the books for the most part—91% of S&P 500 companies have reported, with 75% exceeding earnings-per-share estimates and 60% beating revenue forecasts. The blended earnings growth rate for the quarter stands at 5.3%, marking the fifth consecutive quarter of year-over-year growth. Notably, the growth rate has improved from an estimated 4.3% on September 30, with six sectors showing better-than-expected earnings due to positive surprises, according to FactSet.

The U.S. Federal Reserve (Fed) meeting seemed to be overshadowed during the eventful week despite the Federal Open Market Committee reducing its target rate by 25 basis points (bps) to 4.50%-4.75% on Thursday. The post-meeting press conference was underwhelming as the Fed cited easing labor market conditions and continued progress on inflation back to its 2% target. According to the CME Group FedWatch Tool, markets are pricing in an additional cut of 25 bps in December for a total of 100 bps in 2024. Furthermore, the Fed is expected to cut an additional 100 bps in 2025 before ultimately reaching its terminal rate of 3.25-3.50%. As the new administration takes over, the Fed could take a more cautious approach given change in fiscal policy to ensure that the economy remains in a disinflationary environment.

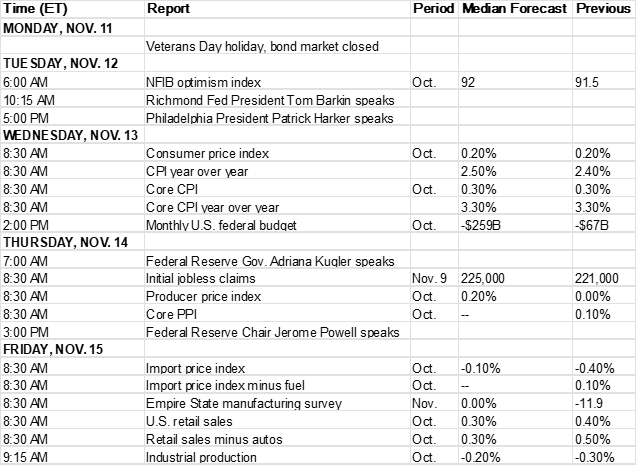

Headlining the economic calendar will be a double dose of inflation data. Hitting the tape on Wednesday will be the Consumer Price Index (CPI); economists are forecasting a 0.2% rise in prices and a year-over-year increase of 2.4%. Thursday will bring an update on Producer Price Inflation (PPI), which is a gauge of “pipeline inflation” or inflation that manufacturers are experiencing. Other notable updates include U.S. retail sales on Friday and key speeches from Fed members throughout the week. The earnings front will be relatively quiet this week with key reports from Home Depot, Tyson Foods, Occidental Petroleum, Cisco Systems, Walt Disney and Applied Materials.

Economic Calendar November 11 – November 16

Links to previously published commentaries can be found at benjaminfedwards.com/Latest Investment Insights/Market Commentary/Market