By Jack Kraft, CFA, Investment Strategist

Print This Post

Print This Post

U.S. stocks remained mostly positive last week as the main focus was on corporate earnings reports. The S&P 500 advanced 1.7% and broke above the 5,100-point level for the first time. Meanwhile, the technology-focused Nasdaq Composite increased 1.4%. The Dow lagged its peers, adding just 1.3%, but still managed to close at an all-time high last week. Additionally, the Dow is getting a shake-up this week with Amazon replacing Walgreens Boots Alliance on Monday. Elsewhere, small and medium-sized companies struggled, with the Russell 2000 down almost 1% on the week.

The gains in large-cap stocks were broad-based, with all 11 S&P 500 sectors finishing the week in positive territory. Pacing the gains were the consumer staples and technology sectors, which advanced 2%, while energy lagged, with an increase of just 0.4%. The center of attention last week was around the semiconductor industry, with Nvidia’s earnings report being one of the most widely anticipated events for markets in 2024. The chipmaker did not disappoint—revenue jumped to $22.1 billion during the quarter from $6 billion one year ago, an increase of 265%. Additionally, guidance was also better than expected, sending shares of Nvidia soaring more than 15%, which managed to add roughly $277 billion in market cap, the largest one-day gain in history. That one-day gain in company size is comparable to the size of the entire company of Netflix.

Last week’s events confirmed to market bulls that the rally surrounding the artificial intelligence (AI) narrative is in fact booming and may still have room to run. One bullish analyst from Citigroup said, “The AI bubble is not in trouble, and, if anything, earnings performance suggests that it is less of a bubble to begin with.” This was supported by Nvidia management’s commentary that mentioned demand is surging across companies, industries and nations, adding that accelerated computing and generative AI have hit a tipping point. In the race of developing the most sophisticated AI, many companies and countries are looking for more efficient ways to leverage the mass amounts of data they have access to without getting left behind.

The AI frenzy has been a key catalyst for the S&P 500’s 20% run in the past four months, despite the 10-year yield staying in the 4.0% to 4.3% range. The buzz is grabbing attention not just in technology but all industries, with over 200 S&P 500 constituents mentioning AI on their most recent earnings call. Many CEOs believe the investment in technology will help increase efficiencies by reducing costs and generating sales.

Some potential overhangs to the recent rally are inflation and economic risks. Recently, inflation has been showing signs of reacceleration, with hotter-than-expected prints coming out of both consumer and producer reports. This has cautioned U.S. Federal Reserve (Fed) members from prematurely lowering the federal funds rate and moved expectations for seven rate cuts at the beginning of the year to just three now. Fed Governor Waller said last week that there’s no great urgency to ease given the strong economy, despite being in favor of cuts to happen later this year. Expect the Fed to remain cautious as it looks to avoid similar policy mistakes made in the 1970s when the central bank allowed inflation to reaccelerate from easing rates too soon.

One pocket of the market that is not enjoying record highs is small- and mid-cap stocks, as measured by the Russell 2000. The Russell 2000 remains roughly 15% below its previous high, which could be attributed to the higher debt load and lower profitability the index holds. Roughly 40% of companies in the index had negative earnings per share over the past 12 months. Another blemish holding the index back may be interest rates staying higher for longer. The Russell 2000 sees a looming debt wall maturing over the next five years that could weigh on profits further as outstanding debt may need to be refinanced at higher rates. With that being said, the index still has plenty of hidden gems, as 60% of its companies are indeed profitable. We think careful stock selection and an emphasis on quality earnings could benefit if small- and mid-cap stocks see a “catch-up” trade to their large-cap counterparts.

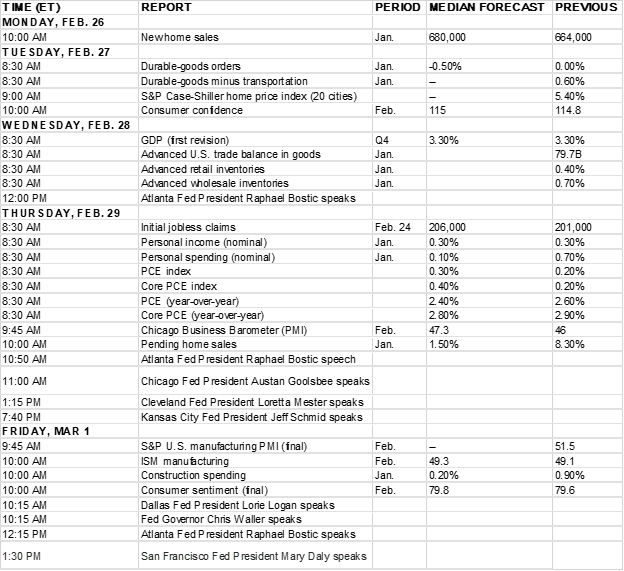

In the week ahead, economic data will be garnering investor attention with the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index report, coming out on Thursday. The real estate sector will get updates on new home sales and pending home sales during the week. Elsewhere, the consumer will be in focus, with a report on consumer confidence during the month of February and the second reading on fourth-quarter GDP. The first day of March will include an update on Institute of Supply Management (ISM) manufacturing data, but no jobs report on this first Friday of the month.

Links to previously published commentaries can be found at benjaminfedwards.com/Latest Investment Insights/Weekly Market Commentary/Market